A Guest Post from Porch.com

Owning a home has long been a part of the American dream. Having your own slice of real estate indicates you are stable, committed, and responsible.

For most Americans, it’s the largest single purchase they will make and most likely their biggest asset. For all the excitement that comes with a first home, the ultimate dream can turn into a nightmare when unforeseen problems surface before the ink on the mortgage papers dries.

Those who have been down the long road of purchasing a first home can attest to the dozens of hurdles buyers must clear before the keys are handed over. Finding the right neighborhood, making the initial offer, haggling over counter offers, scheduling home inspections, and dealing with renovation contractors is enough to confuse even the most organized person.

We surveyed just under 1,000 people, mainly those who have experienced the negative aspects of first-time homeownership, about their most costly mistakes. Paying attention to their advice might save you a lot of heartache and money if you’re considering buying your own place one day.

The homebuying devil is always in the details

You’ve spent enough hours on Zillow and other real estate sites to secure a graduate degree in nuclear physics before finding the perfect place. Writing the first mortgage check gave you a sense of empowerment—an emotional high—one never felt the previous five years of sliding the rent check under your landlord’s door. You are the king (or queen) and owner of your own castle. And then you notice the rotten hardwood floors when you peel back the 35-year-old pea-green carpet.

Texting your landlord to schedule the repair is no longer an option. That’s because you are your own landlord. When the floor guy does arrive, it’s only a few short minutes before he breaks the news that a few damaged wood planks are just the beginning of your problem. A leaking pipe running from the upstairs bathtub has caused the drywall to mold and the ground to soften, resulting in the back bedroom sinking ever so slightly into the soft sandy soil. Ouch.

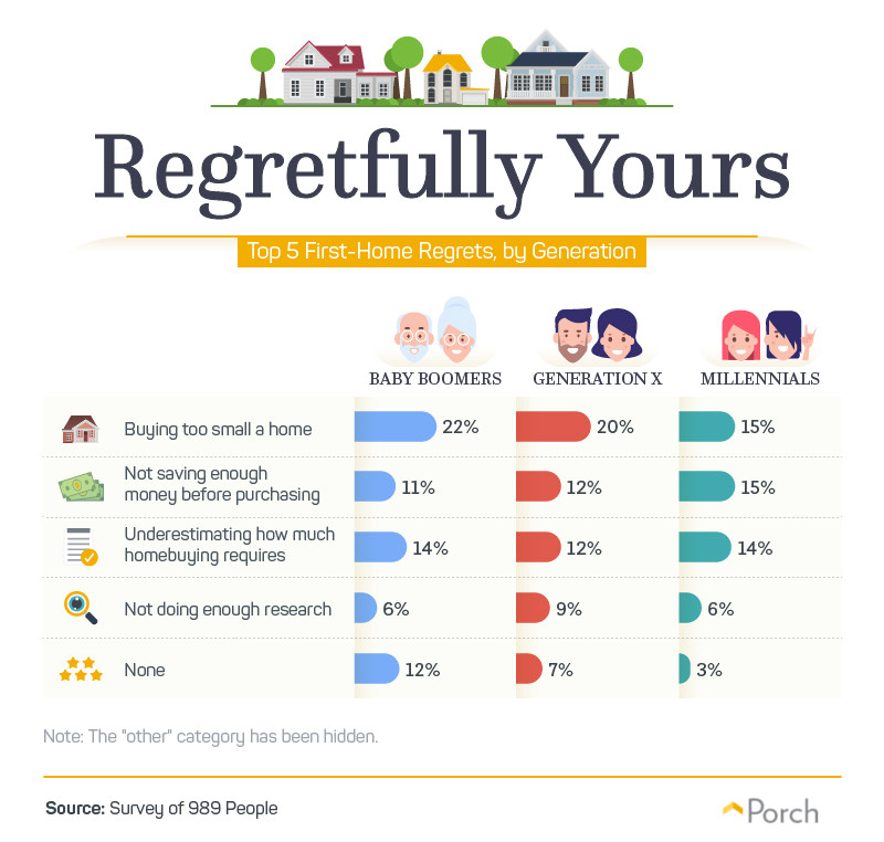

One of the first questions we asked survey participants was their biggest regret after purchasing a first home. Buying something too small was an issue for 22 percent of baby boomers, 20 percent of Gen Xers, and 15 percent of millennials.

By packing your own lunch and declining the previous three long-weekend trips organized by your college roommates, you saved enough of a down payment to qualify for a mortgage. But after the devastating repair news, you have no earthly idea how you’re going to cover the five-figure repair estimate.

That’s why 15 percent of millennials indicated one regret was not saving enough money before making their first-home deal. Along those same lines, 14 percent of both baby boomers and millennials, followed by 12 percent of Gen Xers, said they underestimated how much money owning a home required.

Seeking the advice of a competent and qualified professional contractor or handyman is always a good idea. One of the items they strongly suggest is being present for the final walkthrough to minimize expensive surprises later on.

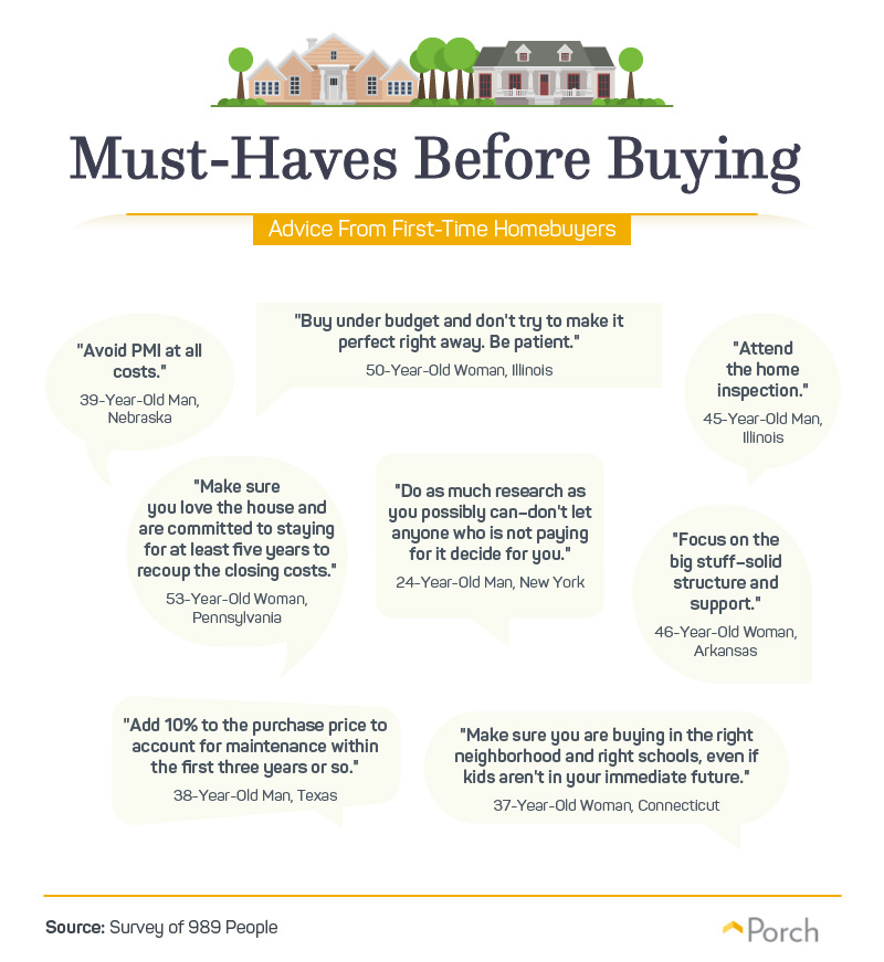

As one 45-year-old man from Illinois wisely stated, “Attend the home inspection.”

The true cost of homeownership

Scraping together the down payment for a first house is only the beginning. Whether you purchase a newly constructed home or a fixer-upper, home repairs and upgrades can quickly drain a checking account. For most buyers, it’s the unexpected costs that present the most significant challenges.

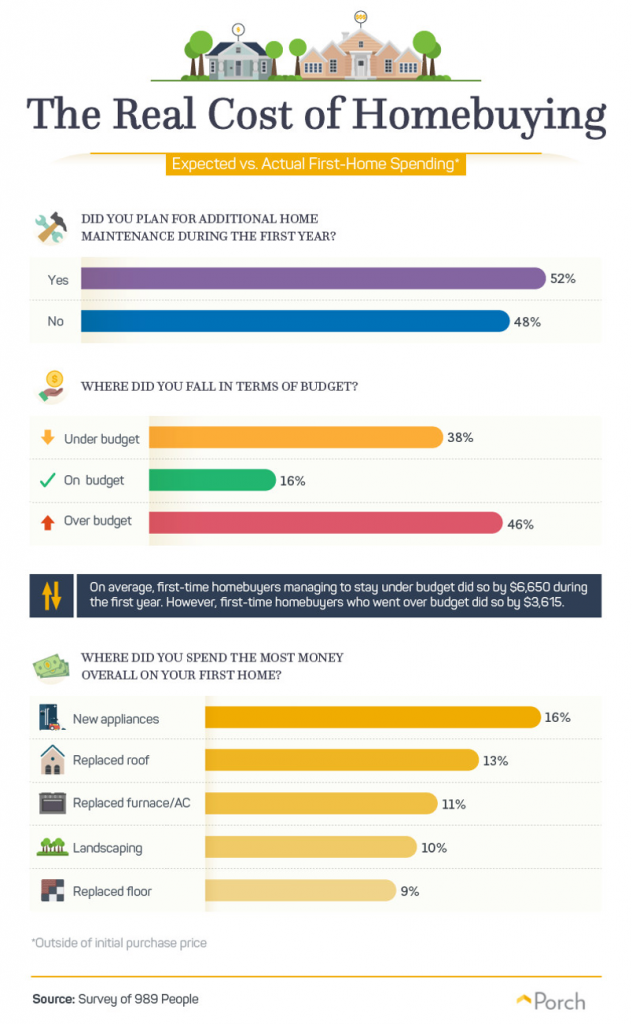

When first-time homebuyers were asked if they adequately planned for home maintenance costs during the first year, 48 percent indicated they had not set aside enough money.

In fact, 46 percent of respondents admitted first-year maintenance costs exceeded the amount anticipated. Only 16 percent stayed within their budget, leaving 38 percent saying their expenses were under budget. The good news for those coming in under budget is the amount they spent was $6,650 less than planned.

Purchasing or replacing appliances was the most considerable expense for 16 percent of first-time homebuyers. That slate green refrigerator purchased in the early 1980s may still keep your food chilled, but it isn’t nearly as fashionable as the double-door stainless model with a touch-screen monitor.

Ranking second at 13 percent of first-time homebuyer expenses was replacing the roof. According to a popular home repair website, the average cost of replacing a roof on a 2,000 square feet single story home can range between $8,500 and $16,500. A few factors determining this cost include size, the pitch of the roof, materials, and accessibility.

Other significant home repair expenses that can wreak havoc on a budget include replacing the heating/AC unit, landscaping, and replacing the floors.

Falling for your first home

It was love at first sight. The manicured flower bed surrounding the wraparound front porch was something you had only seen in a Hallmark Christmas movie. Your dream home really does exist.

It is often said the three most important factors in real estate are location, location, and location. Recent studies do suggest nearly five in six Americans place as much emphasis on the neighborhood as the actual house. Adding money, money, and money to the list seems to round out the top six elements for our respondents.

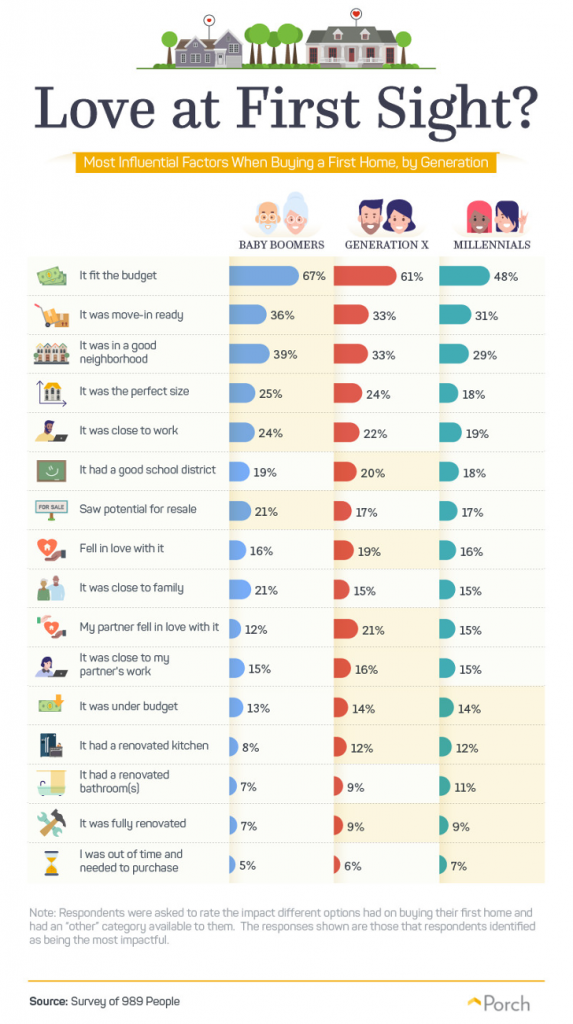

Besides aesthetic appeal, features such as finding a home that fits into a budget, something close to work, and in a good neighborhood makes falling in home-love easier. For 67 percent of baby boomers and 61 percent of Gen Xers, finding an affordable first home was most important. Millennials also placed a high priority on finding something within their budget. Plus, millennials also liked finding a home with renovated bathrooms, just slightly more than the two other generations.

Finding a home that was move-in ready was an essential factor with all generations, with 36 percent of baby boomers, 33 percent of Gen Xers, and 31 percent of millennials.

We know home renovations can get pricey, and one thing that appeals to potential first-time homebuyers is finding a home where the kitchen and bathrooms are fresh and up to date. There are several projects that usually add value to your home and kitchen and bathroom additions/renovations always top the list.

After all, not having to cough up the extra dough for renovations and repairs may allow you to purchase the new sectional sofa you’ve had your eye on.

Location is a factor for many reasons. Most people agree living close to work is an advantage, and if you have school-age children, finding a home in an area with a good school district is important. That’s what 20 percent of Gen Xers said made them fall in love with a home.

Emotions obviously play an important role in purchasing a first home. Our survey results revealed an interesting point in that Gen Xers were more drawn by emotion when deciding what home to buy. For example, 21 percent of Gen Xers mentioned the importance of their partner falling for the right house, which was several percentage points above millennials and baby boomers.

Satisfaction is great, but not guaranteed

Purchasing a first home is not only expensive but can be emotionally exhausting. After the last box is unpacked and the final decorating touches complete, you can now sit back and survey your own castle.

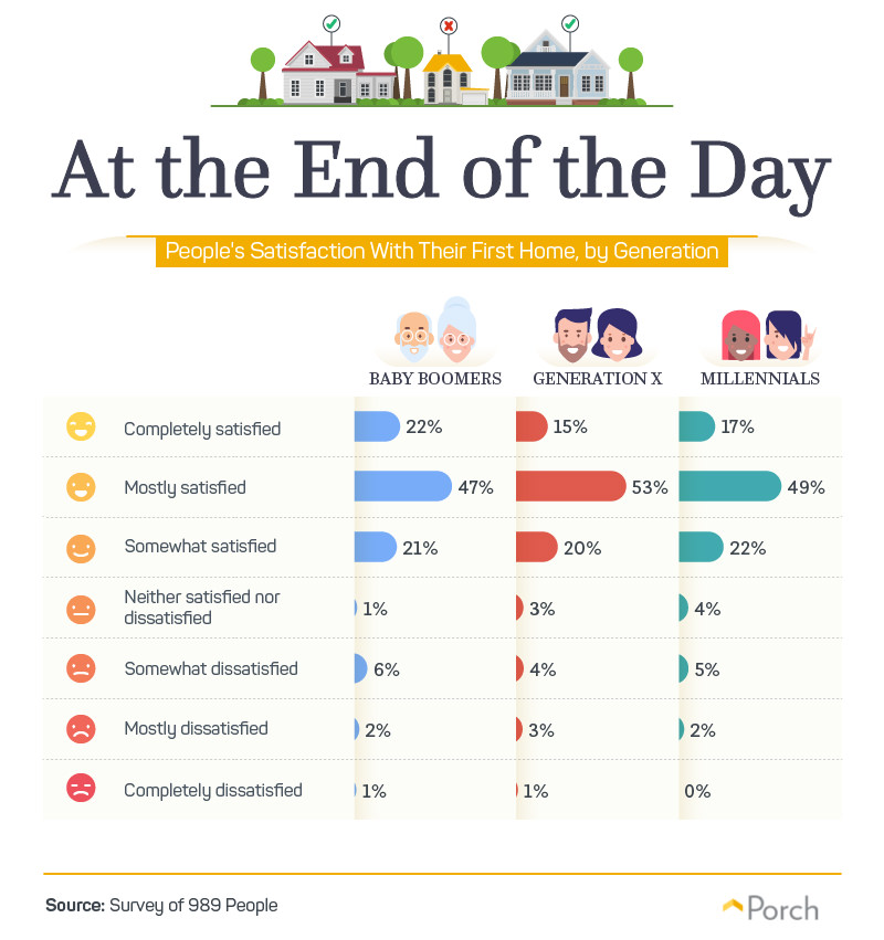

Satisfaction is important with most major decisions. When it comes to being “completely satisfied,” baby boomers led the way at 22 percent, followed by millennials and Gen Xers at 17 and 15 percent respectively.

Interestingly, the tables turned when it came to being “mostly satisfied.” Gen Xers took the top spot in this category at 53 percent; however, millennials and baby boomers were not far behind.

When it came to being “somewhat satisfied,” all three generations were about equal, ranging from 20 to 22 percent.

Sound advice from experienced first-timers

You’re only a property virgin once, and after enduring the marathon process of closing on your first home, you can quickly catapult to the expert division.

If you have already purchased your first home, what advice would you give to others?

“Avoid PMI at all costs,” was the advice of one 39-year-old male homebuyer from Nebraska.

If you are not familiar with the acronym, PMI stands for “private mortgage insurance.” Most mortgage companies and banks require PMI if your down payment is less than 20 percent of the purchase price. So, basically, it’s an insurance policy if the borrower defaults, or fails to satisfy the loan. However, due to the escalating costs of homes, some experts argue not using PMI can end up costing you money. Discussing the issue with your mortgage broker or a financial professional may help you make the decision for your individual situation.

One 50-year-old female advised first-time homebuyers to set realistic expectations. “Buy under budget and don’t make it perfect right away,” she wrote. “Be patient.”

Ah, patience. Who wants to be patient when you’re fixing up your first home? Her advice was also echoed by another 46-year-old Arkansas woman. “Focus on the big stuff—solid structure and support.” That could also be useful advice for entering into a committed relationship, and buying a home is definitely a commitment.

Another piece of practical advice came from a 38-year-old Texas man. “Add 10 percent to the purchase price to account for maintenance within the first three years.”

The lesson from this Lone Star resident is also reinforced by homebuying experts who recommend the “one-percent rule” for home maintenance costs. For example, if the home you are purchasing costs $300,000, setting aside an average of $3,000 annually for maintenance is advisable.

Keep in mind, that ratio doesn’t mean that will be your total costs for maintenance, but a realistic rule of thumb. If you buy a newly built home, there’s a good chance the annual maintenance cost might be lower for the first few years when compared to purchasing a 50-year-old house that is due for major upgrades such as wiring or a new roof.

Lessons from the closing table

Life is full of lessons, and those learned after closing on a first home are invaluable. Some are mundane, but others can be expensive. Now that you’ve gleaned insight from others, hopefully, you won’t repeat some of the more costly ones our survey respondents experienced.

This article was originally posted at Porch.com