Between 1987 and 1999, which is often referred to as the ‘Pre-Bubble Period,’ home prices grew at an average of 3.6% according to the Home Price Expectation Survey.

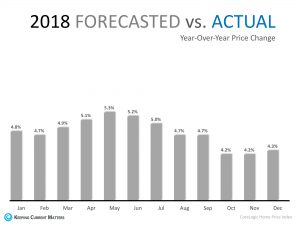

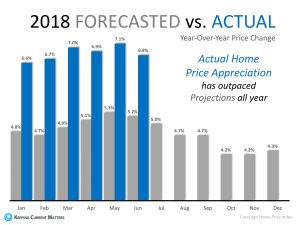

Every month, the economists at CoreLogic release the results of their Home Price Insights Report, which includes the actual year-over-year change in prices across the country and their predictions for the following year.

The chart below shows the forecasted year-over-year prices for 2018 (predictions made in 2017). According to their predictions, the average appreciation over the course of 2018 should be 4.8%, which is still greater than the ‘normal’ appreciation of 3.6%.

What does this mean?

The tale of today’s real estate market is one of low inventory, high demand, and rising prices. The forces at work can be simply explained with the theory of supply and demand. That being said, if a large supply of inventory were to come to the market, prices may start to appreciate closer to the forecasted rate which would STILL be greater than the historic norm!

(Source: Keeping Current Matters)