HOUSING MARKET FORECAST

Whether it’s home prices, mortgage rates or inventory, your clients are probably asking a lot of questions about what to expect in the next couple of months.

Here’s what experts are saying about what’s going to happen with real estate for the rest of 2021.

Interest rates are rising but projected to stay low

One of the biggest drivers for 2021’s booming real estate market was record-low mortgage rates.

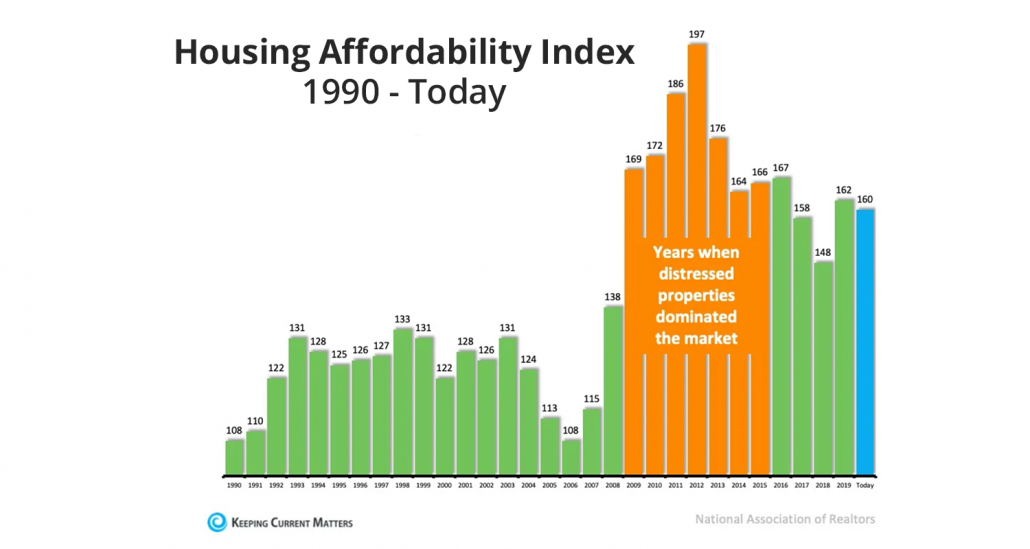

Because of this, affordability reached one of the highest levels it has in the last 30 years. Naturally, eager buyers followed.

The good news is, experts are predicting that mortgage rates will remain low for the foreseeable future.

While home prices continue to appreciate across the country (more on that later), the counter of the low mortgage rates means homes are still affordable to purchase, albeit slightly less than it was at the beginning of the year.

Pro tip: Lots of buyers in the market possibly means another year of bidding wars. Make sure to include language about it in your marketing materials and help set expectations for your clients by sharing infographics like this.

Home sales are slowing but still strong

There’s no doubting it. The last two years have been some of the craziest years in the history of real estate.

While experts are noticing home sales slightly slowing, that definitely doesn’t mean the market is slow. It’s just returning to a more balanced one than we have seen in recent years.

Pro tip: Stay on top of the latest real estate news by signing up for KCM’s Daily Blog emails. You’ll get the top market insights delivered directly in your inbox 5 days a week. Sign up here.

Home prices are appreciating slower too

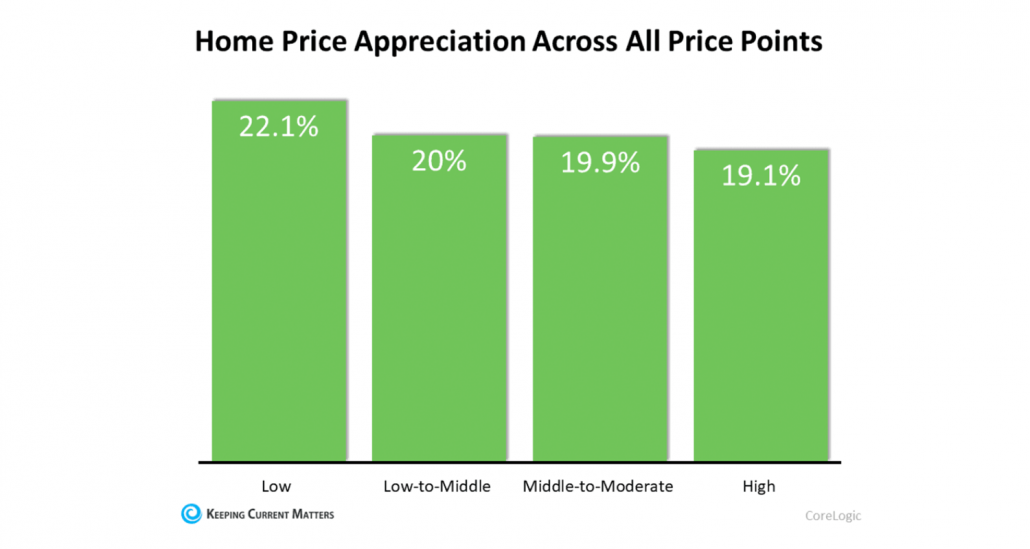

The constant battle between high buyer demand and low inventory in 2021 led to a surge in home values that left everyone scared we were headed for another housing bubble.

There’s no hiding the fact that this year’s home price escalation was a bit excessive. However, it was also just a result of simple economics – high buyer demand coupled with extremely low supply.

As inventory starts to grow, experts anticipate price appreciation will slow.

Foreclosures will happen – but won’t lead to price declines

The massive wave of unemployment that came along with the pandemic led many homeowners across the country to enter mortgage forbearance.

While unemployment is slowly but surely declining (and ahead of expectations), it will be a while before we reach the pre-COVID levels. Because of this, foreclosures are expected to rise.

However, experts don’t anticipate this will lead to anything resembling the foreclosure crisis we saw in 2008. They also don’t expect it to lead to the major home value depreciation that followed.

IS THE HOUSING MARKET GOING TO CRASH BEFORE 2021 ENDS?

All of this leads to the question everyone has on their minds: do all these signs point to a housing market crash?

The answer, according to top real estate experts, is a big “no.”

While memories of the housing crash of 2008 still linger on the minds of many buyers and sellers, today’s market conditions resemble nothing close to what caused it.

Home price appreciation may be high, but it’s also a result of too many buyers and too few homes for sale.

The forbearance situation should be balanced out by the large amount of equity homeowners currently have – meaning they can choose to sell rather than foreclose.

Plus, while affordability may be decreasing, historically speaking, it’s still high compared to most other years.

WHAT DOES THIS MEAN FOR BUYERS & SELLERS FOR THE REST OF 2021?

There is still a lot of motivation for buyers and sellers in the market, and that’s not expected to change in the coming months.

With both inventory and mortgage rates remaining low, both sides of the real estate transaction stand to benefit from making a move before the end of the year.

And while real estate may be slowing slightly across the nation – it’s still strong. Waiting until next year could mean losing out on a less competitive market and better affordability: the two big factors positively impacting buyers and sellers today.

2022 HOUSING MARKET PREDICTIONS

As 2021 draws to a close, you’re probably already getting questions from clients about what experts are projecting for the 2022 market.

The past two years have been full of exciting and record-breaking moments. It’s also seen its fair share of buyer fatigue, hesitancy and confusion.

Here’s what industry experts are saying about what they anticipate for the 2022 housing market.

Home Prices

In the past 12 months, home price appreciation has been the topic of many headlines, and not in a good way. Speculation that we’re in another housing bubble has kept many buyers and sellers hesitant that we’re headed for another crash.

So, what does the future hold for home prices?

It’s important to remember that the 2021 market was anything but normal, and that escalating home values were a direct result of record-low inventory.

However, experts project that the inventory situation should improve in the coming year, stabilizing price appreciation across the nation.

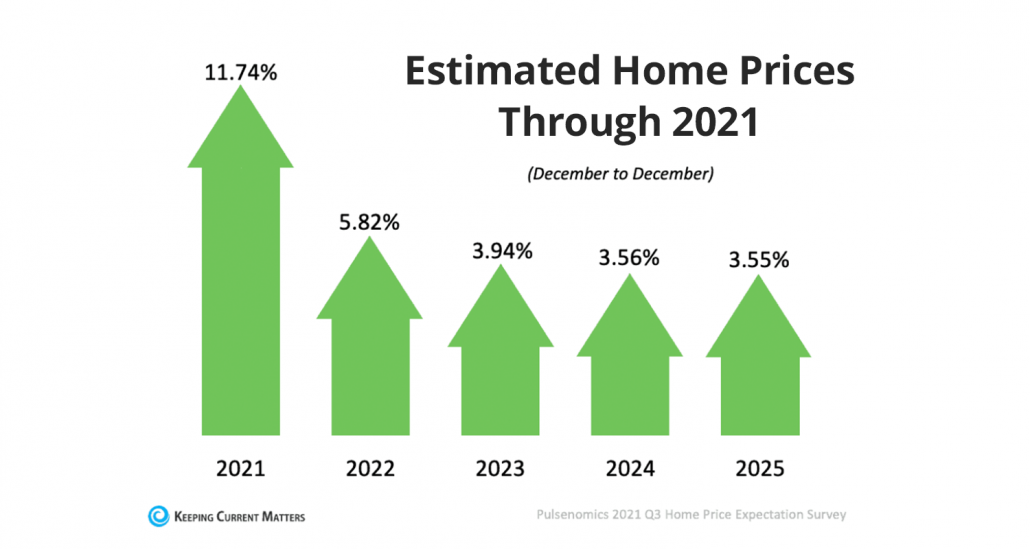

But will home prices depreciate in 2022? Over 100 industry experts don’t think so. Instead, they are projecting a more modest appreciation of 5.82% in the next 12 months compared to the 11.74% rise seen on average in 2021.

Mortgage Rates

In case you didn’t know, the past year saw the lowest mortgage rates in the history of real estate.

So, if you have clients who are waiting for those rates to come back down or go down more, they may be waiting a very long time.

What’s important to remind your clients is that while homes right now may be less affordable than they were a year ago, they’re still extremely affordable.

If we look at the 30-year mortgage rate chronicled by Freddie Mac, we can see the average rates by decade:

- 1970s: 8.86%

- 1980s: 12.7%

- 1990s: 8.12%

- 2000s: 6.29%

- 2010s: 4.09%

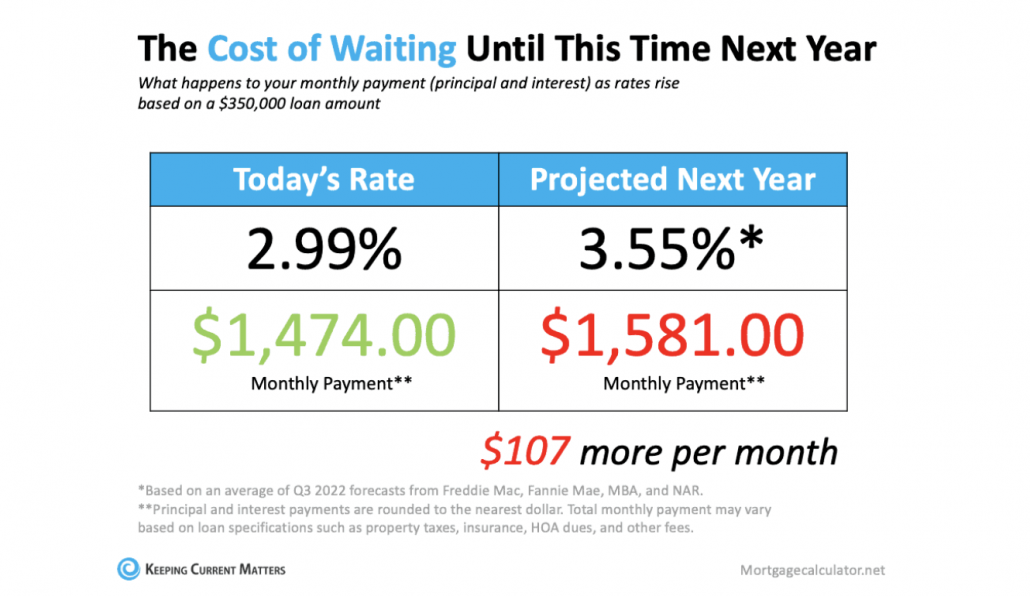

While experts don’t project that mortgage rates will rise a huge amount, any increase would mean an increase in monthly mortgage payments.

A couple decimal points may not seem like a lot to most people, but it could make or break someone’s budget.

If you have buyers that are playing the waiting game, the best advice you can give to them is that a rise in mortgage rates coupled with continued home price appreciation only means one thing: paying more for the same house they’d buy now.

Housing Inventory

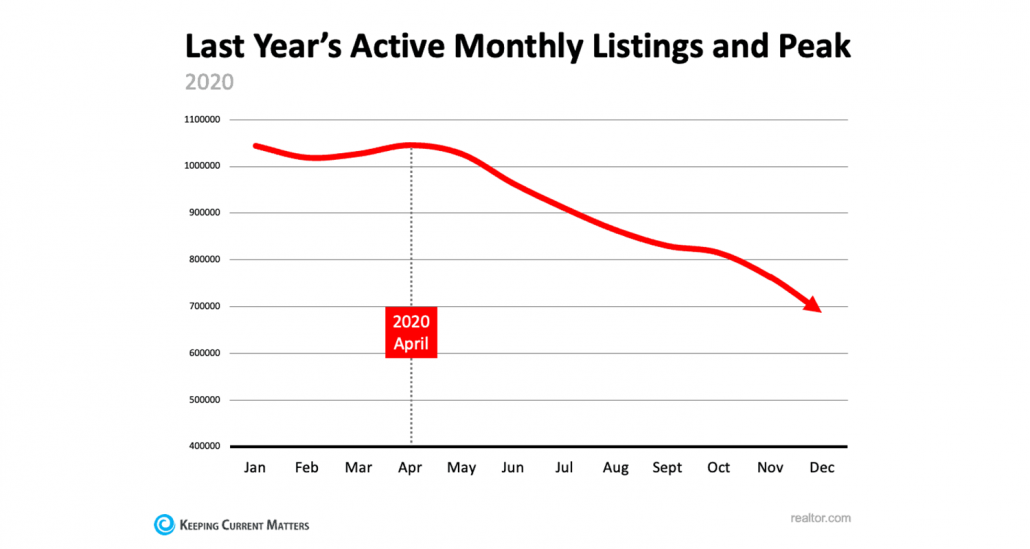

Inventory has been, without a doubt, the biggest player in the anything but ordinary real estate market we’ve experienced in the last two years.

With buyer fatigue running high, you’re probably getting asked, “Will housing inventory increase in 2022?”

The good news is, there are many factors that lead industry experts to anticipate a rise in homes for sale.

Here’s why:

- Homeowners may be more confident putting their homes on the market as COVID numbers continue to drop and more people become vaccinated.

- Many of the obstacles halting or slowing new construction start to fade and those homes come on the market, adding new inventory and meeting the needs of population growth.

- As forbearance comes to a close, experts predict a wave of new homes coming to the market. However, they don’t anticipate the majority of these to be foreclosures. Instead, because of built-up equity, homeowners in this position will have the opportunity to sell instead.

While more inventory may take a bit of the edge off of today’s competitive market, it’s important to remind your clients that it doesn’t mean prices will fall or homes will become more affordable. There will just be more available to choose from.